Building Community

Video Credit: Amherst Business Improvement District

Are You Ready For Homeownership?

Don't Miss Your Opportunity to Own One of 30 Homes Coming 2026!

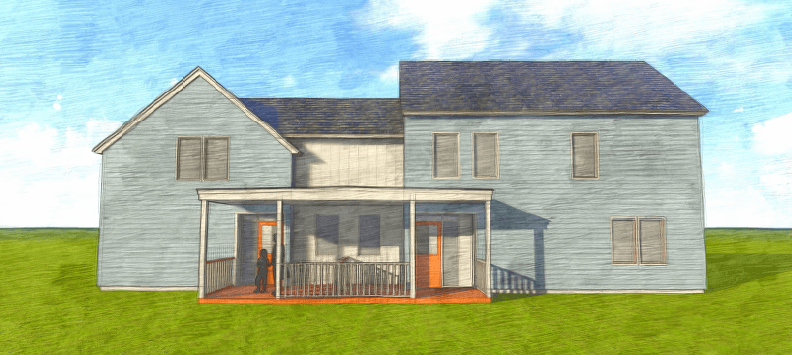

FLOORPLANS & RENDERINGS

MAXIMUM ALLOWABLE HOUSEHOLD INCOME TO BE ELIGIBLE

HOMES WILL BE SOLD VIA LOTTERY TO FIRST TIME HOMEBUYERS WHO ARE INCOME AND ASSET ELIGIBLE.

PLEASE SEE BELOW FOR INCOME MAXIMUMS PER HOUSEHOLD SIZE.

YOU MUST HAVE LESS THAN $150,000 IN ASSETS (BANK ACCOUNTS, INVESTMENT ACCOUNTS, DIGITAL FINANCE ACCOUNTS)

* Income limits above are based on 2025 data. Will be updated once the 2026 numbers are made available.

*The income chart above is used to determine the maximum allowable income to be eligible for these townhomes.

* Household size is the total number of people that will live in your home upon closing.

* Household income is the total amount of gross annual income for all household members 18 years of age and older that generate any form of income. (Gross income is your income BEFORE Taxes and deductions)

* Household size is the total number of people that will live in your home upon closing.

* Household income is the total amount of gross annual income for all household members 18 years of age and older that generate any form of income. (Gross income is your income BEFORE Taxes and deductions)

HOW TO QUALIFY TO PURCHASE

| ||

|  |

Interested?

DOWN PAYMENT AND HOMEBUYER PREPARATION

IS THERE DOWN PAYMENT ASSISTANCE?

YES! There is down payment assistance available. These programs are updated frequently due to funding, so we will create a file with all available down payment assistance programs that can work with this project closer to the lottery date to ensure we provide the most up to date information.

CAN YOU HELP ME BECOME MORTGAGE READY AND PREPARE TO PURCHASE?

YES! Valley Community Development Corporation has partnered with Our Village Initiative and Financial Education Associates to help you prepare for homeownership.

- The team will work as hard as you will toward your goal of homeownership via accountability meetings, follow-ups and action plans.

HELP US NAME THIS COMMUNITY

FAQs

Who is eligible to purchase the new construction condominiums?

To Qualify you need the following:

- Be a first-time home buyer (Exceptions Listed in an FAQ below)

- Be eligible to obtain a mortgage for the purchase price

- Complete First Time Homebuyer Class

- Earn at or below 100% Area Median Income for your household size

- Have less than $150,000 in assets

What types of homets are available?

This affordable housing community offers both 2- and 3-bedroom townhomes that are visitor accessible, catering to a variety of family sizes and needs.

How are the homes sold?

Homes are sold through a lottery application process. This is designed to ensure a fair and equitable opportunity for all eligible applicants to purchase a home.

How do I know if I exceed the household income and asset limits?

The household income and asset limits are established based on the area’s median income and are intended to support affordable housing availability for low to moderate-income families. Specific limits are provided by the housing program/authority overseeing the process and can vary by location and household size. The Monitoring Agent will determine eligibility based on financial documents submitted with the application.

Are there exceptions to the first-time homebuyer requirement?

Yes, there are certain exceptions to the first -time homebuyer requirement. They are:

- Single parent, where the individual owned a home with his or her partner or resided in a home owned by the partner and is a single parent (is unmarried or legally separated from a spouse and either has 1 or more children of whom the individual has custody or joint custody, or is pregnant); or

- Any individual who has owned a dwelling unit who structure is not permanently affixed to a permanent foundation in accordance with local or other applicable regulations or is not in compliance with applicable building codes, or other applicable code, and cannot be brought into compliance with the codes for less than the cost of constructing a permanent structure; or

- Displaced homemakers, where the displaced homemaker (an adult who has not worked full-time, full year in the labor force for a number of years but has, during such years, worked primarily without remuneration to care for the home and family), while a homemaker, owned a home with his or her partner or resided in a home owned by the partner;

How can I apply for a unit?

Interested residents will need to complete a lottery application. The lottery application period will be announced and marketed publicly to ensure all interested residents have an equal and fair opportunity to apply.

You will need a mortgage pre-approval amongst other financial documents to submit with your application to ensure a complete file.

To remain updated on the process, be sure to sign up for our newsletter.

What happens if I am selected for a unit?

This process provides you with opportunity to purchase only. If you have the opportunity to purchase, you will be notified by the Monitoring Agent post selection. At that time, you will need to provide all income, asset and tax documentation to determined program eligibility. If you are determined eligible then you will move forward with the purchase process.

Can I sell the condominium after purchasing it?

Yes, however there may be restrictions on the sale price which depends on how long you own the unit. A Deed Rider will be signed at closing which will state the resale process. The application provides a summary of restrictions based on the 80% and 100% AMI designated units. The Deed Rider will be provided with the Purchase and Sale Agreement, if you have the opportunity to purchase. Please read to ensure you understand and agree to the restrictions.

Where can I find more information?

Please email us with questions. We are happy to assist however we can.

What documents are needed to obtain a pre-approval from a lender?

To obtain a pre-approval you will need the following:

- Past 2 years of W2s

- Past 2 years of Tax returns

- Past month of paystubs

- Past year or last investment account statements

- Past 2 months of bank statements (all pages)

- Contact information for employers from the past 2 years

- Copy of your ID

- Permission to pull your credit

- In addition, if you are self-employed or a contractor, you will need to provide

- Year to date profit and loss statement

- Past 2 years of K1s and 1099s

Interested?

THESE HOMEOWNERSHIP OPPORTUNITIES ARE MADE POSSIBLE BY DEVELOPER:

2025 AMHERST COMMUNITY HOMES | VALLEY CDC | ALL RIGHTS RESERVED

INTERESTED IN LIVING IN THIS AMAZING COMMUNITY?

Fill out the form below and a member of our team will be in touch to learn more about your finances to help you get mortgage ready!

(You will be redirected to a google form for greater detail, please complete this form)

MUST BE INCOME ELIGIBLE THROUGH CLOSING

MUST BE INCOME ELIGIBLE THROUGH CLOSING

MUST COMPLETE FIRST-TIME HOMEBUYER COURSE

MUST COMPLETE FIRST-TIME HOMEBUYER COURSE